Sparklin is a design innovation company

CaratLane - Sparklin Partnership

The Miracle Strategy

Cognitive Gravity

How can we give millions of Indians more control

over their savings?

A lack of understanding of basic financial concepts, such as

budgeting, saving, investing, and more, leaves individuals

vulnerable to poor financial decisions and hence, deprives them

off a possible better and fulfilling life.

ICICI Bank believes that the future of financial security is in

actionable personal finance management.

28M

Users by 2024

9,000B

Total value of transactions in fiscal year 2023

56%

Growth possibility

in transaction value

Discover started with the vision to redefine personal finance in the Asian fintech landscape, offering personalized suggestions to better manage individual financial complexities.

Kapil Makhija

assistant general manager, icici Bank

Working with Sparklin has been an incredible experience. When we began

building our platform, we knew we needed more than just a partner with

banking expertise. We needed someone who truly understood customer

psychology and design, and that's where Sparklin came in.

The synergy between ICICI Bank and Sparklin helped create a platform

that has been widely accepted and celebrated. Their emphasis on

customer-first thinking, design principles, and seamless project execution

was exemplary. What stood out the most was Sparklin's culture of

commitment and adaptability. Even under tight and sometimes

unreasonable timelines, their team went above and beyond to deliver.

UX/UI Design, User Research, Visual Design,

Product Strategy

28M

Users by 2024

9,000B

total value of transactions

in fiscal year 2023

56%

Growth possibility

in transaction value

The age of the digital is paramount for banking institutions to stay relevant. We are honored to have played a crucial role in strengthening ICICI Bank’s dominance in one of the world’s largest economies.

Chai-tastic experience for a country fueled by infinite cups of tea

Revolutionary digital jewellery product exp. made better at stores

Can fresh branding help one compete with the Big 4?

What’s one financial change that revolutionised India?

Modernizing

Internet Banking Experience

Why can’t learning be made fun for the makers of tomorrow?

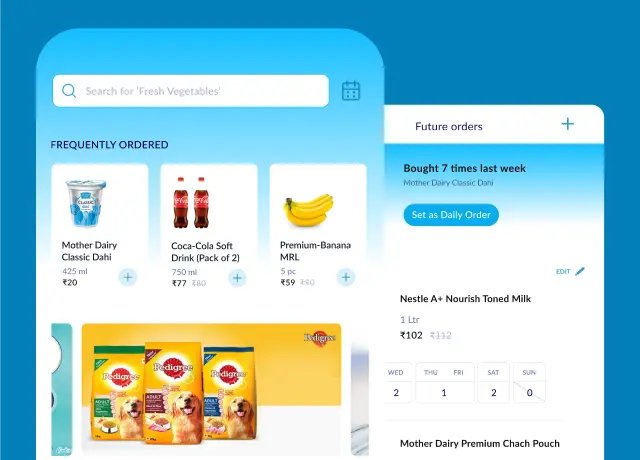

How Milkbasket Transformed Daily Grocery Delivery